Willkommen im HQ SUNGROWs für Europa, das schöne München! Das HQ liegt supernah gelegen am OST-Bahnhof, genauer gesagt in der Balanstr. 58. Dort haben wir einen riesigen Office-floor im 6. Stock von dem schon einige ein paar tolle „Sonnenuntergangselfies“ (was ein Wort,…) geschossen haben. Klar, hier im HQ findet am meisten Trubel statt, es sind tatsächlich sämtliche Teams vertreten und man trifft immer, und ich meine IMMER, nette Kollegen, die Mittagessen ordern wollen. Und hier sind wir auch schon an einem der coolsten features angekommen, nämlich unsere multikulturelle Belegschaft! Klar, logisch haben wir hier Deutsche, aber nebst denen trifft man hier auf etwa 50 verschiedene Nationen aus aller Welt. Viele chinesische Mitarbeiter findet man natürlich ebenfalls hier, es herrscht ein reges Treiben, es ist eine Wonne! Hier in München haben wir elektrisch verstellbare Tische und jede Menge Snacks zur Nervennahrung, sollte man mal was brauchen; Wir wissen nicht woher es kommt, aber in unserem Münchner Office finden sich ständig Snacks, die guten, also die klassischen Fruchtkörbe, und die,… andersguten in Form von Schokolade; jeder ist für sein eigenes Hüftgold verantwortlich 😊 Ich denke als kleiner Vorgeschmack sollte das erst mal reichen; also dann, wir sehen uns in München!!!

Tax Expert - Munich (Germany)

Sungrow Germany • Munich • Finance & Accounting

Servus und hallo zusammen!

Munich

from today

Your duties

- Responsible for formulating the company's domestic and international tax management system and strategy, identifying and controlling tax risks.

- Researching tax policies in key EU markets, conducting tax planning in line with company operations to maintain a reasonable tax burden rate.

- Participating in the review of tax risks related to major contracts, optimizing tax clauses, and establishing key points for contract tax risk control.

- Responsible for preparing tax reports regularly, reflecting and analysing the overall tax situation, and following up on improvement matters.

- Responsible for financial and tax digitalization, leading tax information projects.

Your profile

- Bachelor's degree or above in finance or tax-related majors, with a certified public accountant/tax qualification certificate.

- Three or more years of tax management experience in large multinational corporations or consulting experience in tax firms.

- Clear logical thinking, proactive attitude, excellent communication skills, ability to handle pressure, and willingness to learn.

- Must be fluent in English, German / Spanish / Italian or Mandarin is a plus.

Our offer

Clean and accessible energy is the key to a sustainable future on our planet!

We are market leaders in the solar energy space with the strongest PV-inverter R&D team and we are the largest inverter manufacturer. If you decide to join our team, you will benefit from the following:

Commitment to diversity and inclusion at Sungrow

Our job descriptions were written with inclusivity in mind by using the following criteria:

1) We use a Gender Decoder tool to avoid gendered language.

2) We avoid superfluous requirements by separating essential needs from nice to haves.

3) We do not discriminate based on gender, age, religion, ethnicity, sexual orientation or disability.

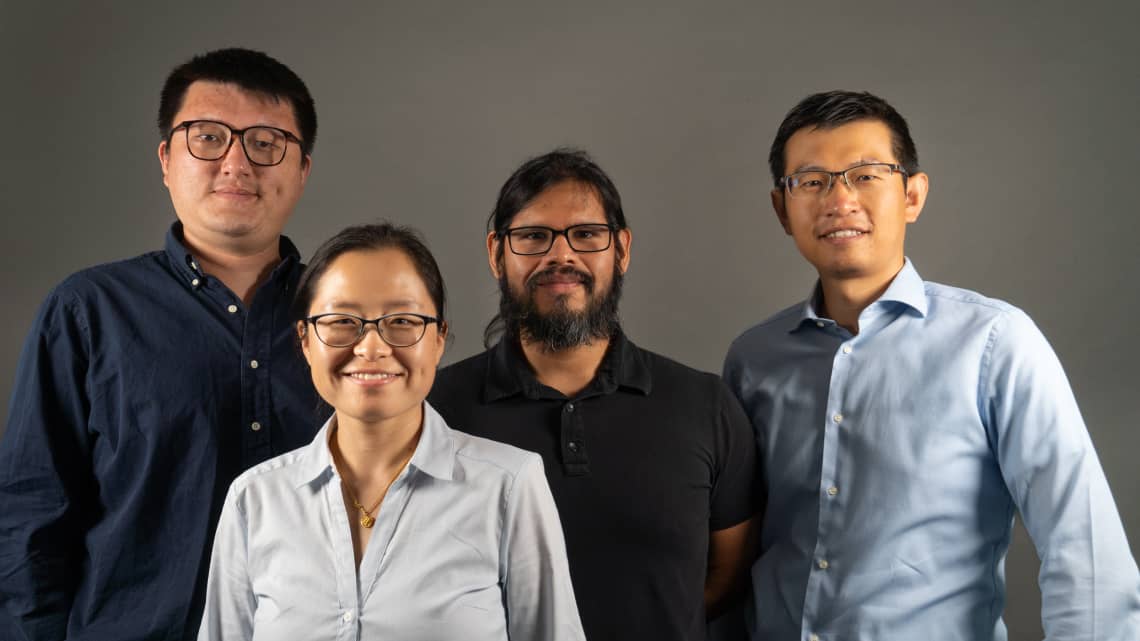

4) We do not use stock imagery in our career page, all photos and videos represent our internal culture.

We are market leaders in the solar energy space with the strongest PV-inverter R&D team and we are the largest inverter manufacturer. If you decide to join our team, you will benefit from the following:

- Opportunities for career advancement as we are growing very fast in the EMEA region

- Bonus payment on a fixed schedule every year based on performance

- A multinational team with a diverse and inclusive mindset

- Travel within Europe for training sessions or to attend renewable energy events

- Opportunity to visit our R&D facilities in China

Commitment to diversity and inclusion at Sungrow

Our job descriptions were written with inclusivity in mind by using the following criteria:

1) We use a Gender Decoder tool to avoid gendered language.

2) We avoid superfluous requirements by separating essential needs from nice to haves.

3) We do not discriminate based on gender, age, religion, ethnicity, sexual orientation or disability.

4) We do not use stock imagery in our career page, all photos and videos represent our internal culture.

You have something superspecial to tell us? Worry not; we know just the right person you should speak to: